Table of Content

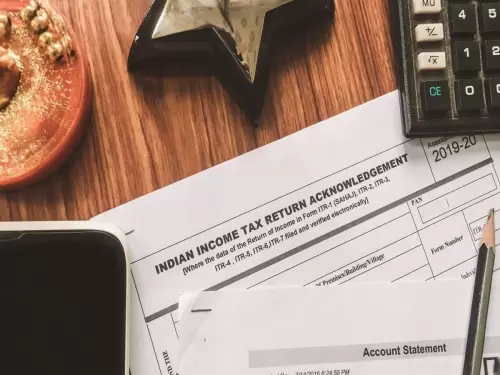

The ITR 1 or Sahaj model is widely used by paid individuals. Sahaj is for resident individuals (other than ordinary residents) who have a gross income of up to 50 rupees, who have salary income, home ownership (individual ownership), interest income and farm income of up to 5000 rupees. However, it is not for an individual who is a company manager or invested in unlisted capital shares.

The last date for ITR submission

At a press conference, the Minister of Finance, Nirmala Seetharaman, has already announced that the deadline for submitting the Income Tax Announcement (AIT) for fiscal year 2020-2020 has been extended until November 30, 2020. From July 31, 2020. The central government also extended the date of pre-tax payment for the fiscal year 2019-20 to 30 June 2020. In addition, the last date for release of Form 16 was also extended from the deadline of 10 June 2020 to 30 June 2020.

For those who were unable to complete the tax savings process before March 31, 2020, due to the blockade led by COVID-19 across the country, the government extended the date until June 30, 2020. It is important to keep in mind that there are no changes in the fiscal year and the extension was made Just to complete the tax savings for the 20-19-20 fiscal year.

Appendix DI - Investment Details

It is also worth noting that ITR 1 or Sahaj Model was notified by the government in January 2020, but they are now reissued. The reissued ITR 1 Form contains information about investments made between April 1 and June 30. This is recorded in Table DI - Investment Details for which the taxpayer must provide details of tax provision investments made between 1.04.2020 and 06.30.2020. “The new ITR models also require taxpayers to provide details of the tax-saving investments / donations made between April 1, 2020 to June 30, 2020 for fiscal year 2019-20 separately, in terms of relaxation granted by the government due to COVID-19 and subsequent closure , "Says Shailesh Kumar, director of Nangia Andersen Consulting.

The convenience of taxpayers is that you are not required to provide certain information now. “ITR 1 released in January searching for detailed information on salary income as well as home ownership income such as TAN, employer’s name and address, and tenant details like name Pan or Aadhaar. These details are no longer said by Saraswathi Kasturiirangan, partner of Deloitte India:“ searched under ITR Present".

New information in ITR 1 form

However, some new information already became part of the ITR 1 model in January 2020. "ITR 1 now also picks up information on whether the taxpayer has cash deposits in excess of Rs 1 crore, and expenditures on overseas travel exceeds Kasturirangan says, that $ 2 Rupees or electricity costs exceed 1 rupees as these requirements lead to the introduction of taxes, even when the taxpayer does not have a taxable income.

Although there is time until November 30 to submit the ITR to AY 2020-21, care must be taken when introducing the ITR. “The forms of the International Telecommunication Regulations are modified according to the new disclosure requirements stipulated in the Income Tax Act for the fiscal year 2020-21. Taxpayers must be careful about these new disclosure requirements, before depositing the International Telecommunication Regulations and choosing an appropriate ITR model.” Nanja warns.

Read more: Drug peddler arrested after filing Income tax returns for 40 lacs income and coming clean about the source

.webp)

_1735214375.webp)